The Investment Consultant Diaries

According to whether you’re in search of a wide-ranging financial program or are merely shopping for investment assistance, this concern will likely be crucial. Financial analysts have actually different ways of billing their customers, and this will frequently depend on how frequently you assist one. Make sure you ask when the advisor uses a fee-only or commission-based program.

The Best Guide To Financial Advisor Victoria Bc

Although you may prefer to place in some strive to find the correct monetary consultant, the job tends to be beneficial in the event the expert offers you strong guidance and assists place you in an improved budget.

Vanguard ETF Shares aren't redeemable immediately using issuing investment except that in very big aggregations really worth huge amount of money (http://connect.releasewire.com/company/lighthouse-wealth-management-a-division-of-ia-private-wealth-341178.htm). ETFs are subject to industry volatility. When purchasing or offering an ETF, you can expect to pay or receive the economy cost, which might be almost than web resource value

Some Known Facts About Independent Financial Advisor Canada.

Normally, however, a financial expert may have some kind of training. Whether it’s perhaps not through an academic program, it is from apprenticing at a financial consultative firm (https://visual.ly/users/carlosprycev8x5j2/portfolio). Individuals at a strong that are nevertheless learning the ropes are often labeled as associates or they’re part of the management staff. As noted earlier, though, many analysts come from different areas

Not known Facts About Retirement Planning Canada

What this means is they have to put their clients’ needs before their particular, among other things. Various other monetary advisors tend to be people in FINRA. This tends to imply that they might be agents whom in addition give expense advice. As opposed to a fiduciary standard, they legally must follow a suitability standard. This means that discover a reasonable basis for their expense recommendation.

Their particular names usually say all of it:Securities certificates, conversely, are far more towards product sales part of investing. Economic experts that also agents or insurance representatives generally have securities licenses. If they right purchase or offer shares, bonds, insurance policies items or offer financial information, they’ll want specific permits about those services and products.

Lighthouse Wealth Management for Beginners

Always be certain to inquire of about monetary advisors’ charge schedules. To find this data on your own, visit the firm’s Form ADV so it files together with the SEC.Generally speaking, there are two types of pay structures: fee-only. private wealth management canada and fee-based. A fee-only advisor’s only kind payment is through client-paid costs

When attempting to understand exactly how much a financial advisor costs, it’s important to understand there are various of settlement strategies they may utilize. Here’s an overview of that which you might run into: monetary advisors could possibly get paid a portion of your general possessions under administration (AUM) for controlling your hard earned money.

10 Simple Techniques For Financial Advisor Victoria Bc

59% to at least one. 18percent, on average. independent investment advisor canada. Normally, 1percent is seen as the standard for approximately a million bucks. Lots of analysts will lower the percentage at higher amounts of assets, so you are investing, state, 1percent for basic $one million, 0. 75per cent for the next $4 million and 0

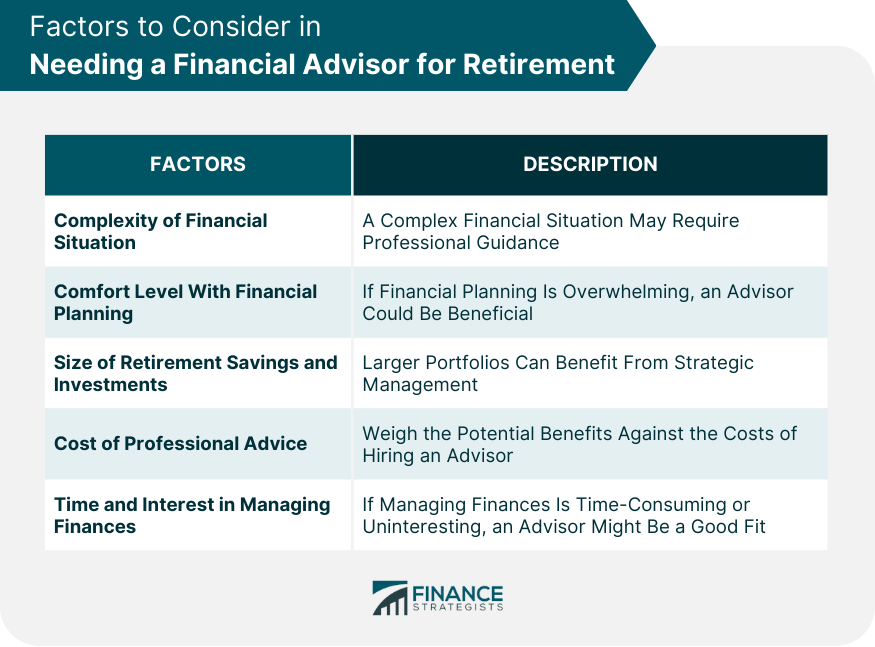

Whether you need a financial consultant or perhaps not is determined by just how much you really have in possessions. You should also consider your own comfort and ease with cash control subject areas. For those who have an inheritance or have recently come right into big sum of cash, then a financial advisor could help reply to your monetary concerns and arrange funds.

A Biased View of Lighthouse Wealth Management

Those distinctions might appear clear to prospects inside financial investment sector, but many people aren’t alert to them. They could think of monetary preparing as compatible with expense management and advice. And it’s correct that the outlines between your occupations have become blurrier in the past couple of years. Expense advisors tend to be more and more concentrated on supplying holistic economic preparation, as some buyers take into account the investment-advice portion are just about a commodity and are searching for broader expertise.

If you’re seeking alternative preparation information: A financial coordinator is acceptable if you’re seeking broad financial-planning guidanceon your own investment collection, but other areas of your plan aswell. Find those that name on their own economic planners and get prospective planners if they’ve obtained the qualified monetary planner or chartered financial specialist designation.

6 Simple Techniques For Investment Consultant

If you would like financial investment information first off: if you were to think debt strategy is within very good condition general nevertheless need help selecting and overseeing your opportunities, a financial investment consultant may be the path to take. These types of people are generally signed up expense experts or are employed by a company which; these advisors and consultative enterprises are held to a fiduciary requirement.

If you want to assign: This setup makes feeling for really busy people who just don't have the time or inclination to sign up during the planning/investment-management procedure. Additionally it is one thing to think about for earlier traders who are worried about the potential for intellectual drop and its own effect on their capability to handle their very own funds or investment profiles.

Not known Factual Statements About Financial Advisor Victoria Bc

The writer or authors cannot very own stocks in virtually any securities mentioned in this article. Know about Morningstar’s article plans.

Just how close a person is to retirement, like, and/or effect of major life activities such as wedding or Home Page having young ones. However these items aren’t under the power over a monetary coordinator. “Many occur randomly and aren’t some thing we can impact,” says , RBC Fellow of Finance at Smith School of Business.

Comments on “The Buzz on Lighthouse Wealth Management”